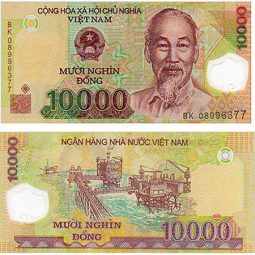

Inflation in recent years has also been well controlled, reinforcing confidence in the Vietnamese dong. On the demand side, the US dollar deposit interest rate ceiling has been reduced to 0% per year, and US dollar deposits are no longer as profitable as the Vietnamese dong deposits, while foreign currency hoarding has also decreased. This is a record high level of foreign exchange reserves in Vietnam. At the same time, the value of Vietnam's foreign exchange reserves as reported by BIDV Securities Joint Stock Company (BSC), have reached US$105 bn. On a national scale, the World Bank and the international cooperation organization on migrants KNOMAD, forecast that the amount of remittances to Vietnam in 2021 will be US$18.1 bn, ranking 8th in the world and third in the Asia-Pacific region. According to the State Bank of Vietnam branch in Ho Chi Minh City, the amount of remittances to the City in the last eleven months is estimated at US$6.2 bn and for the whole year they are estimated from US$6.5 bn to about US$6.6 bn. This year, Vietnam received a substantial flow of remittances. Foreign investors amount reached US$26.46 bn, up by 0.1% over the same period last year, while realized FDI capital in last eleven months is estimated at US$17.1 bn. At the same time, the Foreign Direct Investment Capital (FDI) registered in Vietnam as of 20 November 2021, includes newly registered capital, adjusted registered capital, and the value of capital contribution and share purchase by investors. Accordingly, the balance of trade in goods in last eleven months is estimated at a surplus of US$225 mn. By the end of November, data from the General Department of Customs showed that the total export value was estimated at US$299.67 bn, up by 17.5%, and the total import value was estimated at US$299.45 bn, up by 27. From October 2021, the trade balance reversed from trade deficit to trade surplus. The most plausible reason for the Vietnam dong to appreciate is that the demand for foreign currency is not large enough, while the supply of foreign currency is quite abundant. This is also the lowest exchange rate in the last five years. This corresponds to the State Bank of Vietnam twice lowering the buying price of the US dollar.

The USD/VND exchange rate on the inter-bank market has fallen sharply twice, to VND22,750 per US dollar in August and to VND22,650 per US dollar in early November. Ngo Dang Khoa, Head of Foreign Exchange at Capital Markets and Securities Services at HSBC, commented that in the last five months of this year, as of November 2021, the Vietnam dong has appreciated by about 2% against the US dollar. In the first half of 2021, the exchange rate stabilized around VND23,000 to VND23,100 per US dollar, but in the second half of the year, the US$/VND exchange rate continued to follow a downtrend, meaning that the Vietnam dong showed increase. By 2020, something unexpected happened when the Vietnam dong increased slightly by 0.2% against the US dollar. Since 2001, the Vietnam dong has always depreciated against the US dollar in nominal terms, averaging about 2.5% per year. However, the Vietnam dong is one of the few currencies in the region that has appreciated against the US dollar since the beginning of the year, which is a rare case in the foreign exchange market. Normally, a stronger US dollar leads to devaluation of currencies of other countries, especially the developing countries. At the beginning of 2021, this index was only at 90.535 points. At the session on 3 December, the DXY index continued to hold at a high level of 96.15 points. At one point, the US Dollar Index (DXY) measured the dollar volatility with six other key currencies, namely, EURO, JPY, GBP, CAD, SEK, and the CHF.

In November this year, the US dollar climbed to a 16-month high when the US announced its highest inflation rate in the last thirty years.

0 kommentar(er)

0 kommentar(er)